Forex, short for foreign exchange, refers to the trading of currencies on the global market.

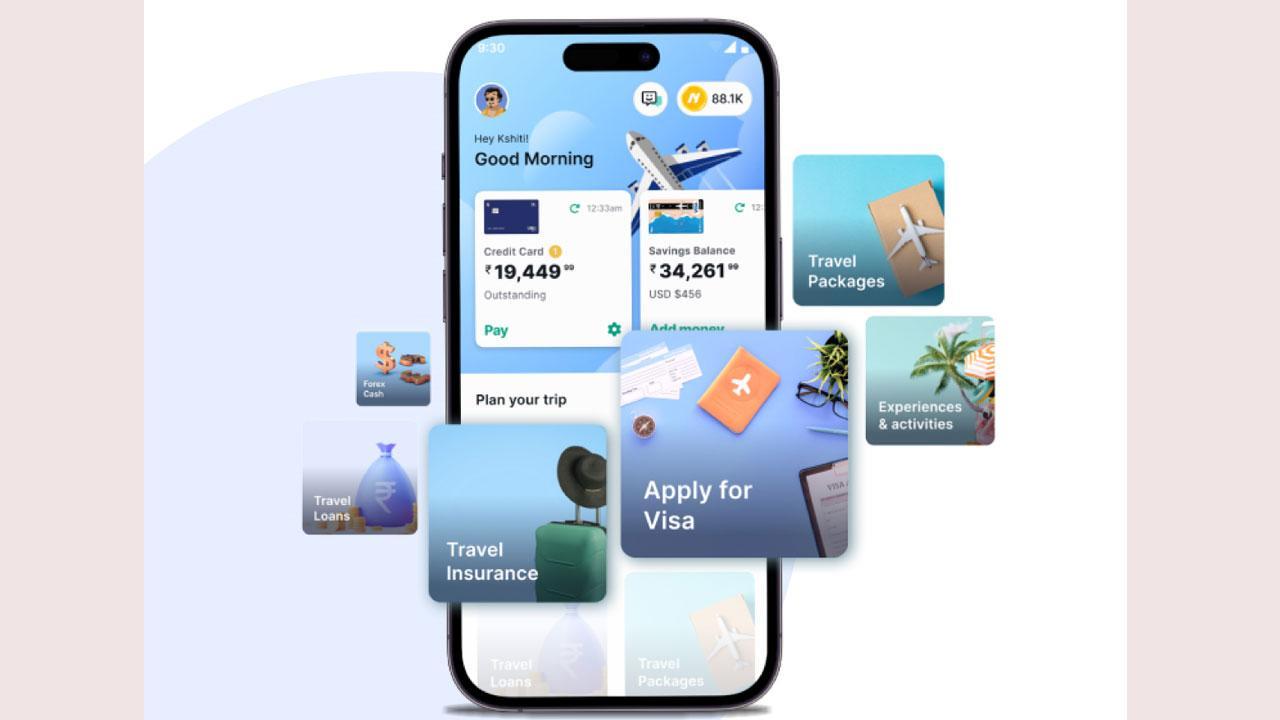

Travelling abroad can be an exhilarating yet daunting experience, especially when carrying foreign currency. Should you carry wads of cash? Or will your debit card suffice? Indian travel freaks now have a better option – multi-currency forex cards! Here’s why these prepaid travel cards trump cash and regular bank cards.

ADVERTISEMENT

What is Forex?

Forex, short for foreign exchange, refers to the trading of currencies on the global market. It allows travellers to exchange one currency for another. For instance, you can trade Indian Rupees for US Dollars, Euros, British Pounds, etc., based on the prevailing conversion rates.

A multi currency forex card provided by banks allows you to store money of different currencies on a single prepaid card. The best ones come with zero forex markup cards, ensuring perfect interbank exchange rates. It serves the same purpose as foreign currency cash but in a safer and more convenient zero forex markup card format.

How Forex Cards Work

Forex cards function like prepaid debit cards with a stored value you can spend overseas. You can purchase forex cards from banks and load up to 8 major currencies like USD, EUR, GBP, etc.

The card has a unique number and comes with a PIN. You can use it simply like a debit card for payments and withdrawals during foreign trips. It deducts money directly from the card balance in the transaction currency without requiring conversion.

Debit Cards

While debit cards also let you transact internationally, they differ from Forex cards in a few aspects:

- Debit cards provide access to your bank account’s funds for international payments. Forex cards have pre-loaded sums, allowing better spending control.

- Debit cards convert all foreign transactions to INR, leading to currency conversion fees. Forex cards deduct money from the transaction currency itself.

- There are risks like cross-border transaction blocks on bank accounts linked to debit cards, which don’t exist for forex cards.

Why Forex Cards Are Better

Here are some of the biggest upsides of using multi-currency forex cards for your overseas trips instead of old-fashioned cash or debit cards:

Protection Against Foreign Exchange Fluctuation

This card can be loaded with as many as 22 international currencies, shielding you from future currency rate fluctuation risks. You can withdraw cash in a local currency or swipe the card directly without worrying about conversion rate changes.

Travel Safe and Worry-Free

Carrying sheaves of foreign currency on you can be risky, especially if they get lost or stolen. Forex cards are much safer due to advanced security features. If your card gets misplaced or stolen, you can instantly hotlist it to prevent misuse, just like debit cards.

Online Usage Allowed

Multi-currency forex cards can be used for shopping online on e-commerce sites, which may not always accept cash or overseas debit cards. You must enable this facility through net banking and set online shopping limits on your Forex card for added security.

Intelligent Use of Funds Across Currencies

An amazing feature of Forex cards is that they can smartly manage balances across different currency wallets on the card for a transaction. Say you select the USD wallet but don’t have enough dollars left to purchase. It will automatically check the balances of other loaded currencies and use them, if possible, to complete your transaction.

The Bottom Line

So why bother juggling multiple currency notes or paying unnecessary transaction fees on debit cards? Forex cards are the most seamless solution for globe-trotting Indians to simplify foreign currency needs.

Their safety, security, convenience and intelligent features surpass old-school cash and bank cards by miles. Forex cards empower you to manage overseas trips cashless and stress-free.

With multiple currency load options, real-time protection from exchange rate changes, smooth online usage and smart balance transfers across wallets – it tops the charts on all aspects an Indian travel addict could ever want!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!