Those who are still unaware of how to go about with a cardless cashless transaction, here are the steps that will guide them through during the bad days of demonetisation

ADVERTISEMENT

With a remarkable intrusion of smartphone, the mobile wallet dream may not be far off for an average customer. The hype over cashless and cardless transactions took a U-turn when our Prime Minister declared ban over 500 and 1000 currency notes.

Since last week, quite a chunk of India’s population is surviving on mobile wallets. We are either impatient, don’t want to take the hassle of standing in a bank or ATM queue or we simply don’t want to bother about demonetised currencies and black money scam. We prefer to go cashless yet pay utility bills on time. Those who are still unaware of how to go about with a cardless cashless transaction, here are the steps that will guide them through:

Step 1- Download the mobile wallet apps from Google play store or Apple i-store. The wallets like Paytm, PayU, MobiKwik, Vodafone M-pesa, Citrus Pay, Oxigen Wallet etc can be downloaded from iOS or Android smartphones.

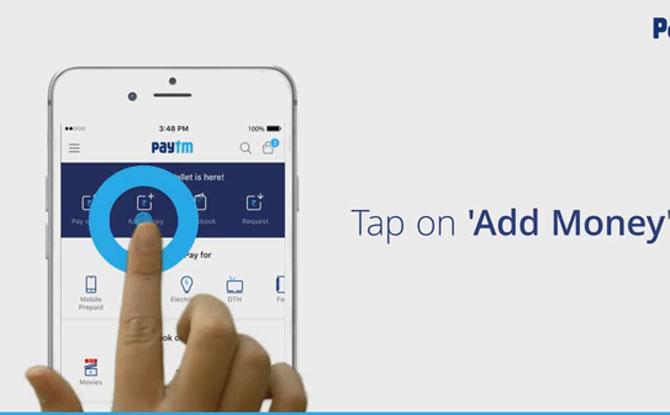

Step 2- Once the app is downloaded or installed in the smartphone, it is ready to use. Choose from any of the options- credit card, debit card or internet banking to top up the wallet with cash.

Step 3- The wallets have tie up with merchants like Zomato, Bookmyshow, Uber, Goibibo, makemytrip, Grofers, Pepperfry, Jabong etc. Any kind of online product purchase, booking tickets or payment of utility bills can be done with the help of these wallets. Go to payment section and choose ‘wallet’ from the payment options. Enter phone number and email id for the transaction. Then the pre-stored cash from the wallet will automatically get deducted.

Step 4- Once the cash from the wallet gets deducted, you will get a notification in your mobile. Within minutes, that cash will get delivered to the merchant from where you have done the actual purchase.

Step 5- Once the merchant receives the cash, you will get a notification too. And then your payment for online shopping or bill paying is done. Within days, you might also get a reminder about the remaining account balance of your mobile wallet. If required, you can reacharge it again.

Your money and bank details are safe with the mobile wallet apps. Some of them like Paytm are also RBI approved and some can be used in offline stores too. Glance through these simple steps and start enjoying cashless transactions from now on.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!