After play store crackdown following mid-day’s exposé, scamsters start posting loan ads on pages of influencers to lure borrowers

The ads for loan apps are now popping up on popular apps and social media platforms

Amid the crackdown by cyber cops from Maharashtra, many other states and neighbouring Nepal on predatory loan apps, a majority of these mobile applications have adopted a new strategy. While many of these instant credit platforms have changed their names on the Google Play Store, several of them are being promoted through ads on the FB and Insta pages of social media influencers, mid-day has found.

ADVERTISEMENT

The police action in India and Nepal gained momentum after a series of reports by mid-day highlighted the plight of mobile app borrowers who were being harassed and blackmailed with their morphed photos. The police have established the role of the Chinese money mafia behind this racket.

The new modus operandi came to the fore after a 34-year-old Bhayandar resident filed a police complaint alleging extortion by recovery agents of a digital lender.

The complainant, an executive of a security agency, said he was watching videos on Instagram on July 30 when he came across an advertisement for the loan app Rupee Tiger. He tapped on the advertisement link and downloaded the app but didn’t apply for any loan.

Also read: Loan app fraud: 12th pass Bihar man was second in command for Chinese kingpin

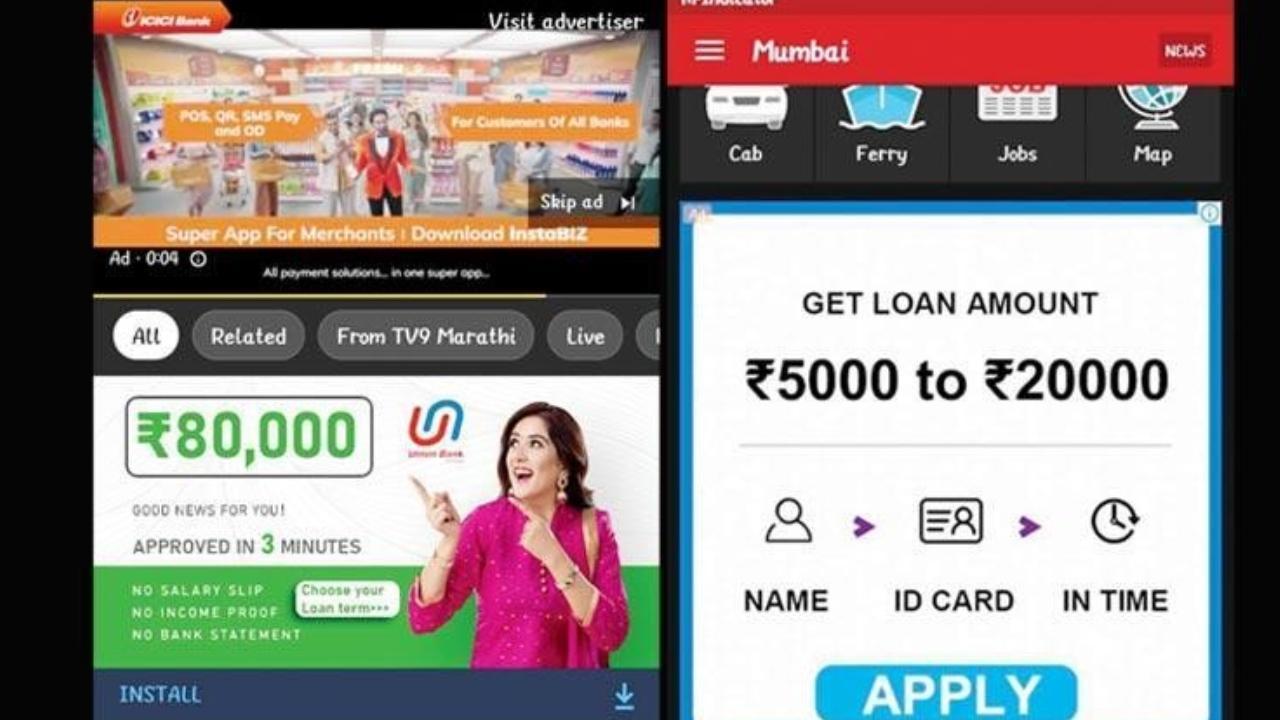

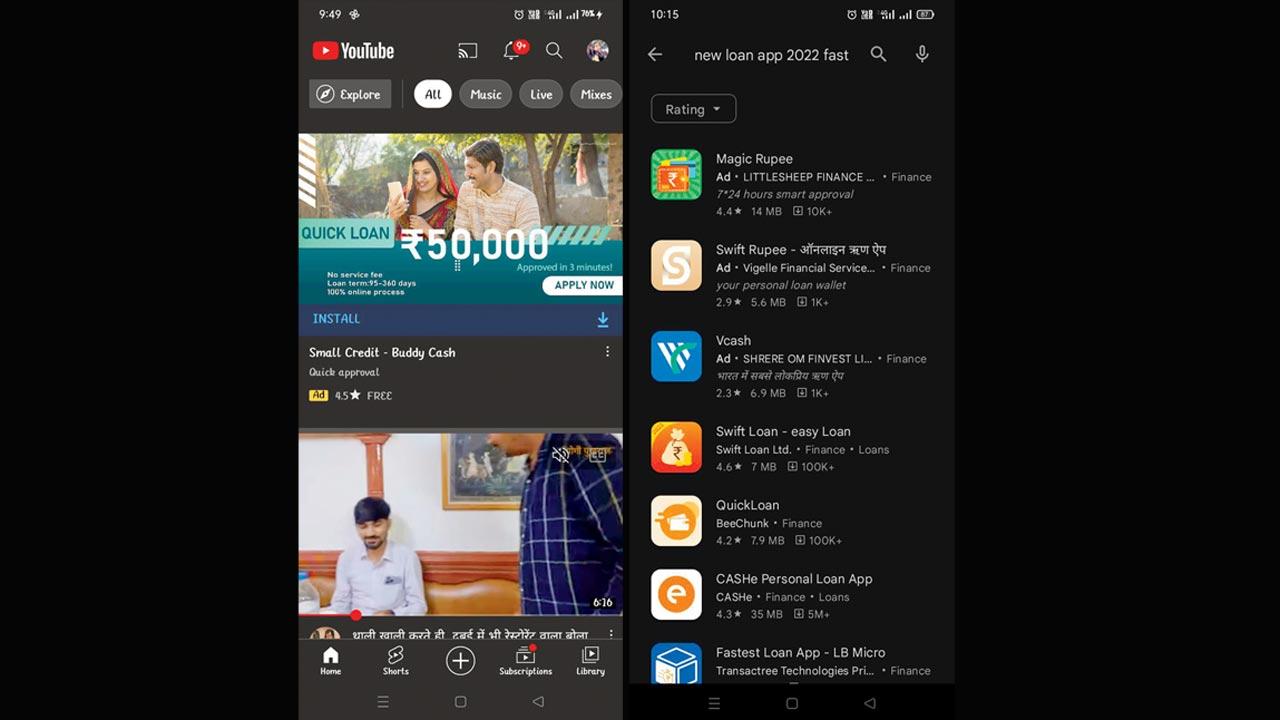

A loan app ad appears on a YouTube video; (right) Several new apps are now showing up on Google Play Store

A loan app ad appears on a YouTube video; (right) Several new apps are now showing up on Google Play Store

The complainant told the police that Rs 1,600 got credited into his bank account. Soon, he got a message on WhatsApp asking him to pay Rs 3,000. Subsequent messages threatened to share his morphed photos with all his contacts.

“When the complainant asked the agents to show proof that they indeed had access to contact details, they sent him the numbers of his wife, daughter and son apart from his PAN and Aadhaar number. Scared, the man paid Rs 3,000,” said an officer from Bhayandar police station.

Just when the man thought he had got rid of the problem and heaved a sigh of relief, his account again received R1,600 followed by the demand for Rs 3,000. He paid this amount as well. But when the deposit-and-demand cycle repeated for the third time, he approached the police. On August 4, the Bhayandar police registered a case under IPC and the IT Act.

Cyber expert Swapnil Patil said the Reserve Bank of India has so far removed more than 200 fake loan apps from the Play Store with the help of Google.

Patil said, “Many loan apps change their name and come back to the Play Store with a different identity. Many loan apps have started putting their links in the form of ads on the videos of social media influencers on Instagram and Facebook, apart from the videos on YouTube. People turn greedy seeing ads and then become victims of cyber frauds.”

Rs 1,600

Amount that got credited into the complainant’s account

Rs 3,000

Amount the man was asked to pay each time

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!