Gung ho is the defining mood of the moment

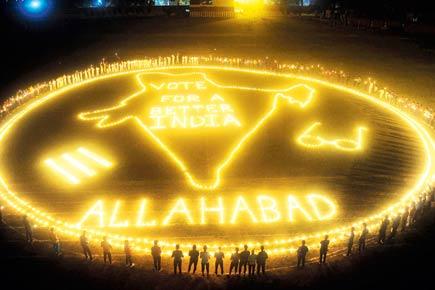

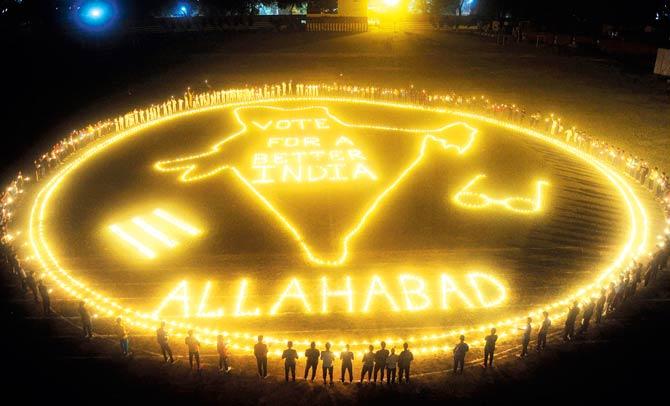

Candles are lit in a giant mural in a stadium during a voting awareness campaign organised by the Allahabad District administration. Pic/AFP

Candles are lit in a giant mural in a stadium during a voting awareness campaign organised by the Allahabad District administration. Pic/AFP

ADVERTISEMENT

Sensex and Nifty closed positively on Friday, especially Sensex, which hit a five-month high. One interesting point is that on Friday, private sector banks (especially HDFC Bank) supported the market. HDFC Bank made a new, 52-week high on Friday after RBI withdrew a ban on the withdrawal limit. The rest of the sector remained weak.

Going forward, the market tends to remain in a narrow range between 8965-8715. A break above or below, can give a direction to the market. The BMC election on February 21 and the Friday holiday may restrict investors from creating big open positions.

The daily charts are on the sell side, but weekly and monthly charts are still on the buy side and will give investors an opportunity to enter at lower levels for medium term to long term.

Falling India VIX is also a good sign which ended at 13.34 on Friday. The latest concerns are raising VIX of S&P 500, which rose above 10 and Federal Reserve's intension to increase interest rates as soon as next month.

If there is a rate hike in the US, then we can expect heavy sell-off in the equity markets and commodity markets.

An eye on IT

Bank Nifty gained extensively last week and will face resistance at 21001. It may get support at 20381 and 20068. Banking Nifty charts are also suggesting overbought situations. So it is prudent to create small open trading positions this week. Nifty IT index is also overbought; we saw profit booking on Friday due to overbought situation.

It is very difficult for the IT index to move above 10647 and it has strong supports at 10453 and 10326. On the daily charts of the Nifty Metal Index, already entered into the oversold situation, so one can expect marginal buying interest. Ambuja Cements, KSB pumps, Castrol India and Merck are the few companies which will announce quarterly earnings, with these results, Q3 earning seasons will come to an end.

Can make an impact

Major events that can affect the market in a big way are state election results and roll out of GST, apart from the US interest rate hike. There is a strong possibility that the US FED will increase interest rates very soon, because the macro-economic data which comes out suggests strong economic growth of the US economy. The latest data of US initial jobless claims was above market analyst expectation, jobless claim increased by 5000 while compared to the expectation for 11000. US stock markets are also suggesting weak upward momentum; DOW JONES has resistance at 20619 and support at 19797.

US initial jobless claims, continuing jobless claims are due from US. From the Euro zone analysts are keen to have cues on Balance of Trade, unemployment rate, inflation rate, GDP growth rate and Industrial Production. On the domestic front, Foreign Reserves, GDP growth rate and Industrial Production data is expected this week.

Alex K Mathews is the founder of www.thedailybrunch.com

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!