With value erosion in the bourses, confidence is yet to return to the marketplace

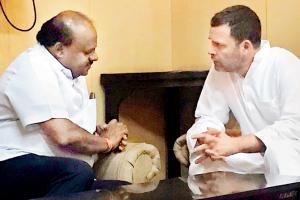

Cong president Rahul Gandhi met Karnataka Chief Minister H D Kumaraswamy in Bengaluru on Saturday. Gandhi also met Hindustan Aeronautics Ltd staffers in the wake of the Rafale fighter jet deal controversy

It was a crazy and super volatile week at the bourses. On two days, Thursday and Friday, the BSESENSEX moved by more than 700 points on a net basis. The total daily change on five days was 2,225 points with a gain of 1,231 points on three days and a loss of 934 points on two days. The net change for the week saw BSESENSEX gain 356.59 points or 1.03% to close at 34,733.58 points. Similarly on NIFTY the gain was of 428.50 points and a loss of 272.45 points for a cumulative change of 700.95 points. NIFTY gained 156.05 points or 1.49% to close at 10,472.50 points.

ADVERTISEMENT

The broader markets saw the BSE100, BSE200 and BSE500 gain 1.46%, 1.49% and 1.55% respectively. BSEMIDCAP gained 1.98% and BSESMALLCAP was up 2.25%. The top sectoral gain was BSEOIL&GAS up 8.53% followed by BSEBANKEX 4.23% and BSEPOWER 2.44%. The top sectoral loser was BSEIT down 7.03% followed by BSETECK 1.79% and BSEMETAL 0.45%. In individual stocks the top gainer was HPCL up 24.38% followed by Yes Bank 16.42% and Eicher Motor 11.66%. The top loser was Tata Motors down 18.08% followed by TCS 9.63% and Vedanta 8.24%. Dow Jones was under pressure and lost 1,107.06 points or 4.37% to close at 26,447.05 points. Dow on a calendar year to date basis is up 2.5%, having lost a lot of it during the week. The Indian Rupee saw recovery on Friday to gain 21 paisa or 0.29% for the week at Rs 73.56.

During the week the rupee had touched a low of Rs 74.95. On a calendar year to date basis, BSESENSEX turned positive after Friday's gains while NIFTY is marginally in the red. BSEMIDCAP and BSESMALLCAP are down 24.75% and 35.82% respectively, indicating the amount of pain and value erosion in the space. Even at these levels, confidence is yet to return to the market place.

In primary market news, the issues from Aavas Financers Limited listed on Monday October 8 and had a poor debut. Shares were issued at R821 and after having a discovered price of Rs 758, closed for the day at Rs 773.15, a loss of Rs 47.85 or 5.83%. Delivery volume as compared to the IPO size at 3.74% was extremely low and this could be because the issue was undersubscribed in retail and HNI categories. The share at the end of the week recovered marginally to close at Rs 780.85, down 4.89%.

The other share to list was PSU Garden Reach Shipbuilders and Engineers Limited which had struggled to get subscribed. The issue was extended and just about managed to get subscribed. The issue had a discovered price of Rs 104 against an issue price of Rs 118.

The share closed at Rs 105.90, a loss of Rs 12.90 or 10.93%. At week end the price had fallen to Rs 102.05, a loss of Rs 15.95 or 13.52%. Delivery volume was extremely low at under 1% of the issue size. One must remember that about 46 lac shares or 15.75% of the total 2.92-crore issue was from HNI's, Retail and Employees. This effectively means that the share could remain under pressure for some time till deliveries from these investors is absorbed.

The poor subscription, one issue being withdrawn, and poor listing performance of recent primary issues has put temporary brakes on the primary market. New issues though ready to be launched are playing the waiting game to allow market conditions to stabilise. One is not sure how many issues would see the light of day in the remaining part of calendar year 2018 which has effectively just about two months to go.

There is a trading holiday on Thursday, October 18, for Dussehra, which could act as a dampener for markets and the rally which is likely to continue from Monday onwards. Markets have seen a strong correction over the last 5-6 weeks and it appears that they have bottomed out in the immediate short term.

Results declared by TCS and Hindustan Lever are impressive and give comfort in terms of growth going forward. While these two results cannot form the basis of results to follow at least things have started on a positive note.

It makes sense to continue to ride the wave in the coming days. While no clarity emerges yet on the trade wars so far. This issue could always act as the hurdle in smooth function of the markets. Use sharp rallies to book profits while dips could be used to enter the market on the long side.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd.

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only.

Catch up on all the latest Mumbai news, crime news, current affairs, and also a complete guide on Mumbai from food to things to do and events across the city here. Also download the new mid-day Android and iOS apps to get latest updates

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!