After a crypto exchange firm suspended operations, everyone is asking: Should you still trust recommendations by finfluencers?

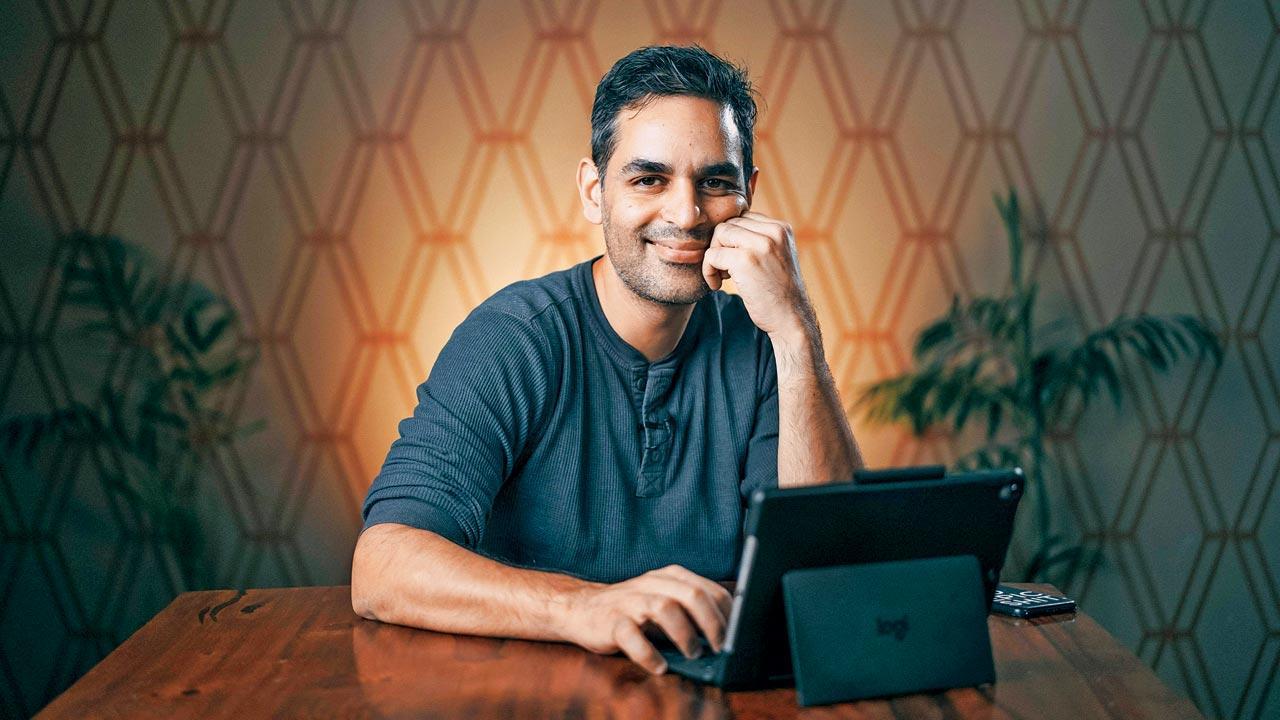

Finfluencers Ankur Warikoo and Akshat Shrivastava had both recommended Vauld. Warikoo said he got paid R4.47 for making the promotional video. Pics/Instagram

On July 4, Vauld, a Singapore-based crypto firm founded by Darshan Bathija and Sanju Sony Kurian in 2018, suspended all transactions (deposits, withdrawals or trading). The platform used to let individuals buy, borrow, lend, and trade in crypto currencies. Vauld said that the suspension of withdrawals was the result of massive customer withdrawals since June 12, 2022, amounting to over $197.7 million. The world crypto markets have also dipped due to investor fears, with the global market cap shrinking to $1.02 trillion from $1.10 trillion as of June end.

ADVERTISEMENT

The first sign of trouble came on June 21, when Bathija tweeted that Vauld had to lay off up to 30 per cent of the workforce. One of Vauld’s USPs was that it offered the investor “crypto fixed deposits”—meaning, it allowed you to place tokens in a FD for 30 days and reap principal plus interest at the end of the term. “I understand that a lot of our customers are nervous about their funds,” Bathija, who is also Vauld’s CEO, has since tweeted. “We are working tirelessly to ensure your finances are protected. We have signed an indicative term sheet with Nexo to acquire up to 100 per cent of Vauld.”

It wasn’t long before Finfluencers (finance influencers) and YouTubers such as entrepreneur Ankur Warikoo, Akshat Shrivastava, and Anish Singh Thakur, who run the channel Booming Bulls, were called out on social media for promoting Vauld and its FD module. Warikoo and Shrivastava even invested in the platform, with Warikoo saying that he had Rs 30 lakh stuck. Investors were filling up the comment sections with the amount of money that they had lost in Vauld, just because their favourite influencers told them to invest in it.

Also Read: ‘Population control not about stats but welfare distribution’

Shrivastava made a new video, in which he tried to take responsibility and explain what happened. When we spoke to Warikoo, he said, “Vauld has not shut down. It has ceased operations. Big difference. So please don’t state that anybody has lost money. That is false and will only lead to more paranoia during what is already a difficult situation. Yes, I have invested through Vauld for my crypto purchases and that money is stuck just as everyone else’s. However, crypto forms less than six per cent of my total investment and within that, Vauld was even lesser. This is what I have always suggested, with the same risk appetite—no more than 5-10 per cent of your investments should be in crypto.”

Shantanu Jain, Ankur Jhaveri and Jyothsna Yallapali

Shantanu Jain, Ankur Jhaveri and Jyothsna Yallapali

Warikoo then emphasised that Vauld had the right credentials for the web3 world—a founder with relevant experience and a strong reputation, imminent investors whose due diligence one can trust, a product that works really well and a strong proposition for the user. “I spent time on Vauld as a user, then with Darshan for about a month asking questions, post which I decided to endorse it as a product that I personally use,” Warikoo said. “In hindsight, would I have done things differently? Probably not; I would have still used it myself and spoken about it to others. The standard I hold myself to is: Is there skin in the game for me? Talk is cheap. Will I be affected personally if my words do not hold in the future? If yes, I do it because I am responsible for the consequences of my actions.” Warikoo has said that he was paid Rs 4.47 lakh for the Vauld promotional video posted on his channel on October 19, 2021.

Though Warikoo can afford to take this stand, with most of his followers looking to him for more than just financial advice, the question begs to be asked: Should finfluencers on YouTube and Instagram be more mindful, and ethically responsible for what they ask their followers to invest in/buy? And should they be regulated? In the past few years, financial influencers have become a most-wanted creator. They advise followers on everything from ‘How to buy your first share’, ‘How to make your first million’, to ‘How to save tax’. That most influencers share knowledge in simplified terms makes them a hit in Tier 2 and 3 cities as well. A well-established finfluencer can reportedly charge anywhere between Rs 10 lakh and Rs 30 lakh for a promotion.

Ravisutanjani Kumar, Yuvan Seth and Shavir Bansal

Ravisutanjani Kumar, Yuvan Seth and Shavir Bansal

Former chief manager of Kotak Mahindra Bank, Shavir Bansal, is the founder of Bekifaayati, which has 898K subscribers. He says that a lot of due diligence goes into making their videos, which hold advice on credit card debts, earning passive incomes, and finding out more about your savings accounts. “Given the kind of backing Vauld had, this is extremely shocking,” he says. “Our intention is to focus on education, and avoid talking about brands, and products, if there is even a tiny risk of investors losing money. Even when we give insurance advice, we lay it all down and say, ‘These are the pros and cons. Make your decision after assessing it all’. In finance, there is no right answer that fits everyone.” Yuvan Seth, co-founder at RicherToday, which has 148K subscribers on Instagram, says that while many brands approach them, they run thorough checks before collaborating. “We even put our money in,” he adds, “and see how that does for a while, just so that we are not caught in a difficult place. The outcry is predictable, but I don’t think influencers are wrong. Sometimes, risky businesses shut down. The audience needs to be aware. Crypto brands will be hit for a while, and it’s better not to talk about them until the situation is sorted.”

Then there are those who may have seen the loopholes in what Vauld was offering. Shantanu Jain, co-founder of ReadOn.in, a finance-media brand that aims to demystify the finance and startup space, was also approached to create a video and a write-up. “We started doing our due diligence,” says Jain, “It got tricky: They were offering 12 to 14 per cent interest on crypto FDs, which is unsustainable and unrealistic. They wanted us to say ‘guaranteed returns,’ and we couldn’t figure that out! In fact, some very famous influencers whom I personally respect tremendously, also called it less-risk [investment], and that’s not okay. Crypto is very high-risk. You have to educate your followers about it, and let them figure out if they want to invest based on their risk-appetite and capacity.”

Even though it may be easy right now to blame the creators, it also would be imperative to admit, that no one can get it right all the time. Ankur Jhaveri, founder and CEO of Jackfruit, a tax saving and money management portal, says that it’s important for influencers to be fully qualified, much like in China where you can’t give financial advice without holding a degree in Finance. “Many 20-year-olds are giving advice on Instagram as well. That’s a red flag! But several legitimate influencers—such as Warikoo and Shrivastava—have said it clearly: one must invest in crypto only what they are ready to lose. And they invested too. Maybe they put their money in a hard wallet, which most people don’t know about. The hard wallet doesn’t exist on the Exchange; it exists in the Blockchain, where you have control over it.”

This is why investors need to educate themselves completely, especially in the case of crypto, where the future is still a bit hazy. As Ravisutanjani Kumar, Vice-President of Partnerships at Testbook, a preparation site for competitive exams, says, “In India, people get enticed and forget to look at the fine print. I believe people who have brand equity, come with a trust factor, and take accountability. The last-mile person does not have the knowledge, so you can’t sugarcoat anything, and keep repeating the risk factor.” Jyothsna Yalapalli, a strategist for startups, says Vauld’s move to pump money into influencers was itself irresponsible. “As an investor, do your own research, and know that anything that is not market-liked is a red zone. Crypto ka concept hi hazy hai! Also, it’s not supporting the world in any way or being inclusive, like UPIs. So be very careful.”

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!