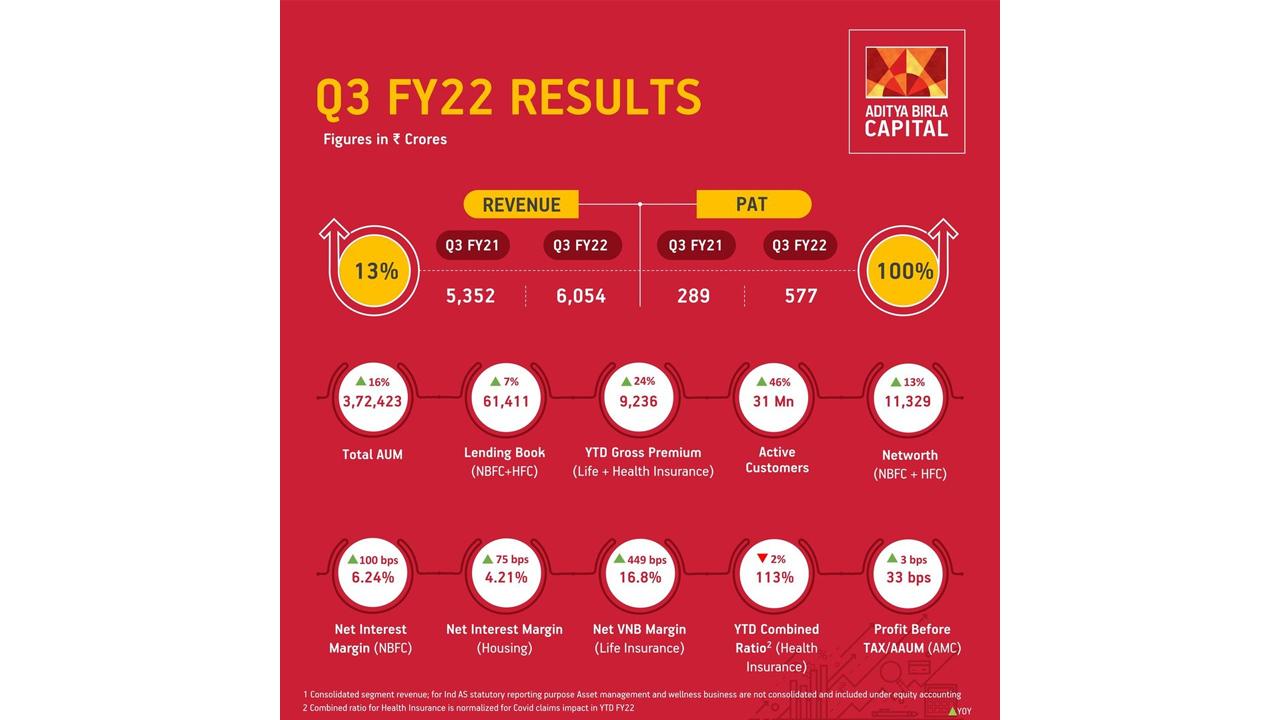

Aditya Birla Capital Ltd (ABCL) recently announced that its consolidated net profit more than doubled to Rs 577 crore in Q3 FY22 Results, the company's highest-ever quarterly profit. In the same quarter, the net profit was Rs 289 crore, a year before. ABCL said in a release that consolidated revenue increased by 13% to Rs 6,054 crore in Q3 FY22, compared to Rs 5,352 crore in the same quarter of FY21. The net profit of Rs 577 crore is the highest ever achieved by the firm, and it includes a net profit of Rs 161 crore from the sale of about 1 percent stake in the AMC (assets management company) business via its IPO in October 2021; says ABCL in a statement.

ADVERTISEMENT

The whole lending book (NBFC and Housing Finance) increased by 7% year on year to Rs 61,411 crore, establishing it as a lending portfolio of scale. The loan portfolio of the NBFC arm increased by 9% year on year to Rs 49,805 crore. According to the organisation, its net interest margin increased by 100 basis points year on year to 6.24 % due to growth in the retail and SME categories and decreased borrowing costs. The lending book under its home finance arm amounted to Rs 11,606 crore. Its net interest margin increased by 75 basis points year on year to 4.21 % in Q3 FY22.

The company's focus on expanding its retail base and producing continuous profitability is bearing fruit. As a result, the active customer base has increased by 46% year on year to 31 million. In addition, the company's total assets under management (AUM) spanning asset management, life insurance, and health insurance increased by 16% to Rs 3.72 lakh crore.

Retail, SME, and HNI currently account for 67% of the non-banking finance company's overall lending book, according to ABCL.

ABCL's future strategy will be to maximise the value of its 31 million active customers while continuing to drive client acquisition at scale. Other areas to look for include integrating technology and data to increase revenue per client, enhance customer experience, reduce expenses, and construct scalable systems. ABCL's stock finished at Rs 124.85 a share on the BSE, down 1.03 % from the year-earlier close.

Since July 2007, Ajay Srinivasan has been serving as the Chief Executive of Aditya Birla Capital, the holding company of the Aditya Birla Group's financial services businesses.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!