An online bank account is a digital evolution of traditional banking.

Banking is evolving, offering a streamlined experience that fits the pace of our lives. Opening a bank account online is not just a convenience; it's a seamless financial experience waiting to be explored. If you've been hesitant or perhaps unaware of the simplicity that online banking offers, this guide is your key to demystifying the process. Forget the paperwork and long queues. Explore straightforward steps and unveil the advantages of managing your finances with just a few clicks.

ADVERTISEMENT

What is an online bank account?

An online bank account is a digital evolution of traditional banking. It offers a seamless banking experience from the confines of your home. This savings account is managed entirely online and eliminates the need for physical bank visits.

This digital financial hub goes beyond the basics. It empowers you to effortlessly transfer funds, settle bills, initiate Fixed Deposits, explore Mutual Fund investments, and even fulfil your tax obligations, all without stepping away from your couch. The online savings account simplifies your financial interactions and you can also avail the cheque book services.

Eligibility Criteria for Opening Savings Account

Considering the convenience of opening a savings account online, it's essential to understand the eligibility criteria. For Kotak Bank's Savings Accounts, the process is streamlined, offering diverse benefits beyond mere savings.

- Resident Indian Requirement: To be eligible for a Kotak Savings Account, you must be a resident Indian.

- Age Criteria: The minimum age requirement is 18 years.

- Inclusivity for Foreign Nationals and HUFs: Foreign nationals residing in India, members of Hindu Undivided Families (HUFs), HUFs themselves, and minor children are also accommodated. However, it's crucial to note that certain types of Kotak Savings Accounts cater specifically to these categories.

How to open a bank account online?

Open bank account online is a straightforward process. Here is a step-by-step guide to begin your savings journey:

- Contact Details and Aadhaar Verification: Enter your contact details, ensuring you use the mobile number linked to your Aadhaar. This step establishes a secure connection and streamlines communication.

- PAN and Aadhaar Details, OTP Verification: Input your PAN and Aadhaar details for verification. An OTP will be sent to your Aadhaar-linked mobile number. Keep your original PAN card accessible for this secure process.

- Mandatory Profile Information: Complete all required profile information. If your communication address differs from your Aadhaar's, add a communication address to ensure the accurate delivery of important documents.

- Declarations and Consent: Read the bank’s terms and conditions and provide your consent. This ensures a clear understanding of the agreement between you and the bank.

- Initial Funding: Deposit the initial amount needed to activate your savings account. This step marks the beginning of your financial journey with the bank.

- MPIN Setup for Mobile Banking: Set up your MPIN, a crucial step for securing and accessing your mobile banking functions. This personal identification number adds an extra layer of protection to your account.

- Video KYC Process: Complete the video KYC process to activate your Kotak savings account. This innovative and secure method ensures your identity is verified, providing a robust layer of protection for your financial transactions.

Interest rates of savings account

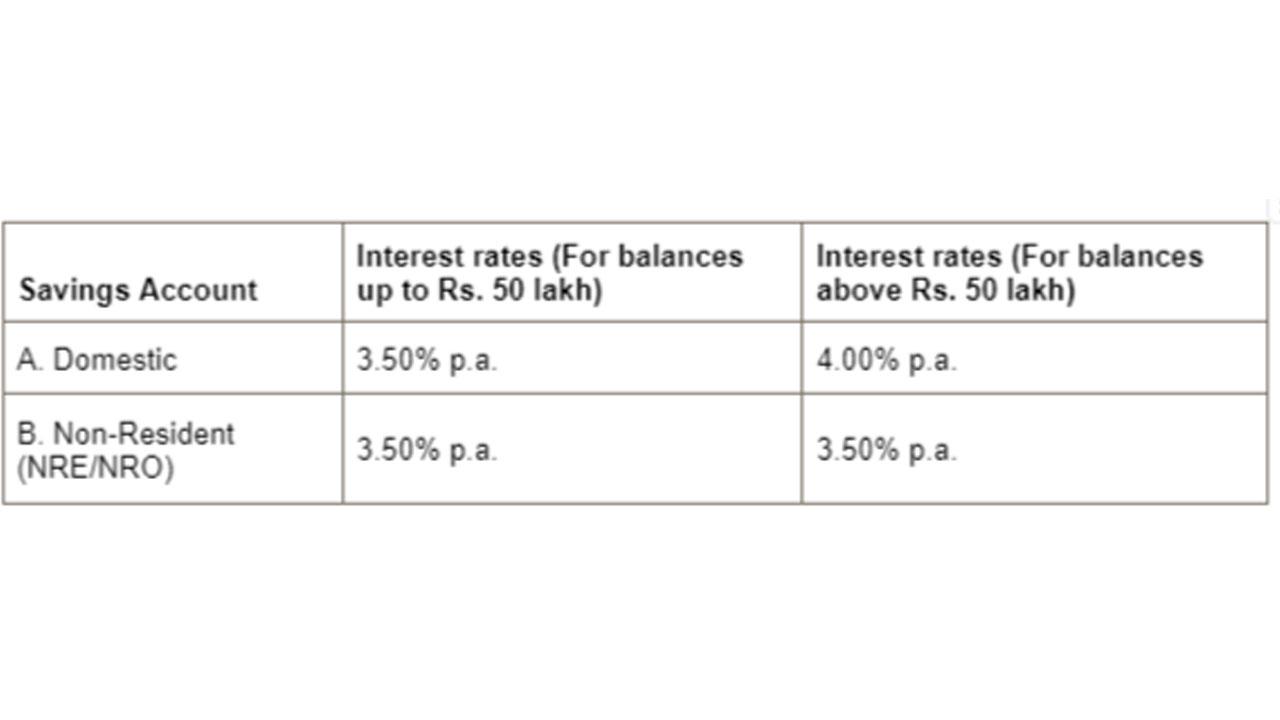

Learning savings rates is essential to optimise your financial gains. The latest interest rates are as follows:

For those looking to earn higher interest rates, consider opening Kotak Edge Savings Accounts which enables you to earn up to 7% interest on your surplus balance exceeding Rs 25,000 with the ActivMoney facility.

Conclusion

Opening a bank account online ensures a hassle-free banking experience. Start by choosing a reliable banking partner like Kotak, smoothly completing the application, and meeting the necessary KYC requirements. This simplified process removes traditional barriers, making banking more accessible. The digital landscape offers convenience and efficiency beyond physical branches.

FAQs

Q: Can anyone open a bank account online?

A: Yes, virtually anyone can open a bank account online. Most banks provide easily accessible online account opening services, offering convenience for individuals seeking to manage their finances digitally.

Q: What do I need to open a bank account online?

A: To open a bank account online, you typically need a valid government-issued proof of identity, proof of address, and your Aadhaar number. Ensure you have these documents ready for a smooth application process.

Q: How long does it take to open a bank account online?

A: The time to open a bank account online varies but is generally quick. With efficient digital processes, completing the application and verification steps can take as little as 10 to 15 minutes.

Q: Are online bank accounts secure?

A: Yes, online bank accounts offered by top banks employ advanced security measures, including encryption and multi-factor authentication, to ensure the safety of your information. Be sure to choose a reputable bank like Kotak that follow robust security protocols.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!