Learn about the various credit scoring models and what makes them different from each other.

Your credit score is a numerical representation of your credit history, used by lenders to assess your creditworthiness. It’s often synonymous with your CIBIL Score, which is the most popular scoring model in India. But did you know there are other credit scoring models too? Each has its unique approach, and it’s well worth the time to understand what sets them apart and why it matters to you.

ADVERTISEMENT

Understanding CIBIL Score

Developed by TransUnion CIBIL, the CIBIL Score is a credit scoring system that is most widely used in India. As a credit bureau, TransUnion CIBIL collects and maintains credit information of individuals and companies and generates a three-digit numerical score ranging from 300-900 to signify their creditworthiness. The higher your CIBIL Score, the better your chances of getting a loan or credit card approved on terms that are favourable.

Wondering how your CIBIL Score is calculated? Well, there are several factors that are taken into account to determine your CIBIL Score and, consequently, reflect your creditworthiness, such as:

1. Credit history, including the number of credit accounts you have, their types, and their duration

2. Payment history, including your credit card and loan payment behaviour and whether you have made them on time

3. Credit utilisation, or the ratio of the credit you have used compared to the total credit available to you

4. Credit mix, or the variety of credit you have availed of, such as credit cards, personal loans, home loans, etc.

5. Credit enquiries, or the number of times you have applied for credit in the past

Other credit scores in India

Understanding how your CIBIL Score works gives you a solid foundation from which to explore how alternative credit scores available differ. Here are the three popular ones:

1. Equifax

2. Experian

3. CRIF High Mark

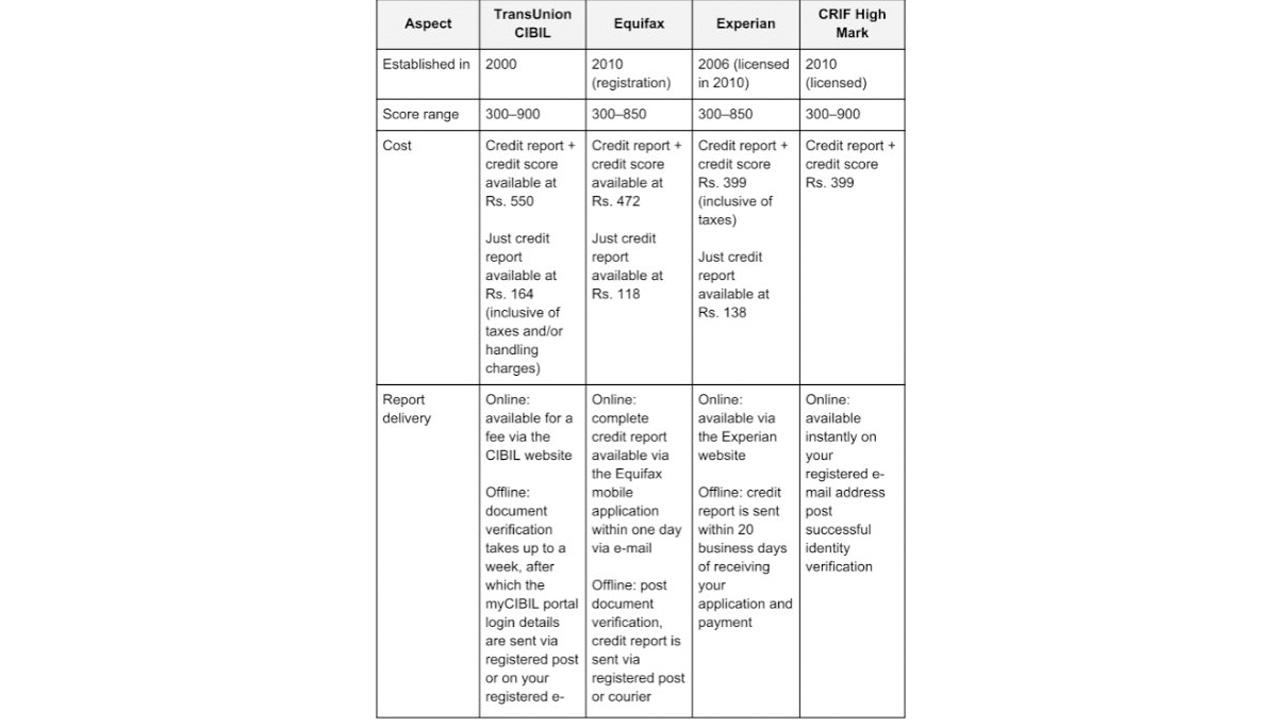

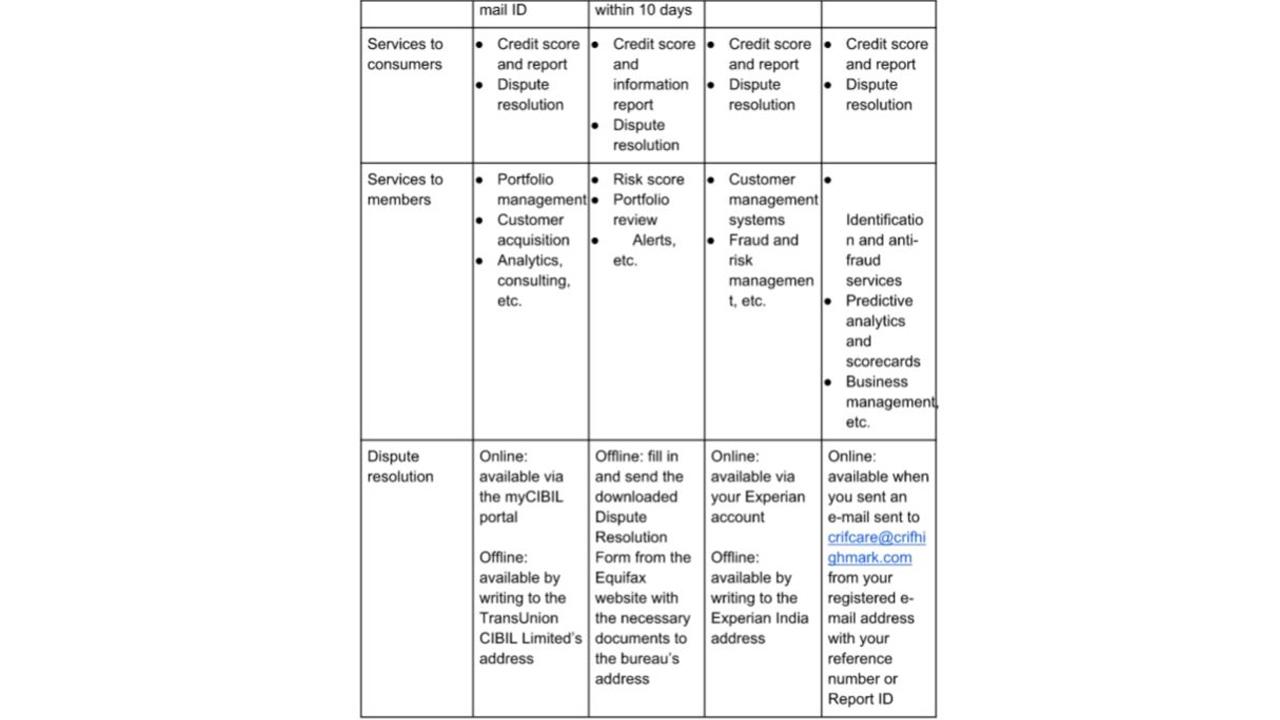

All of them provide credit scores to lenders, just like TransUnion CIBIL, but with some key differences that are outlined in the table below:

Things to keep in mind

- Your score may vary from one credit bureau to the next because each bureau uses its own methods of calculation, considering diverse factors

- Your credit report and score from any one of these credit bureaus is equally valid, in spite of differences between them as all four credit bureaus are RBI-licensed

- Your credit report is accessible to you as a consumer (or a commercial entity), banks and financial institutions, insurance companies, government agencies, collection agencies, employers, and telecom service providers as well

- New credit information and/or changes are reported by banks and financial institutions to credit bureaus every month, based on which your individual credit report is updated

No matter which credit bureau you depend on, remember to monitor your credit report regularly. Doing so will help you to identify any mistakes or fraudulent activity and immediately report it to the concerned credit bureau for redressal. Errors can be damaging to your credit score but you can easily fix them with proactive and timely intervention.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!