The week ahead is likely to be volatile and take direction from what RBI does or says

The markets began trading for the new financial year with a bang. They say well begun is half done and if the three days of trading are an indicator it’s a great start. In the three days of trading the Sensex gained 801.50 points or 2.92 per cent to close at 28,260.14 points while the Nifty gained 244.85 points or 2.94 per cent to close at 8,586.25 points.

ADVERTISEMENT

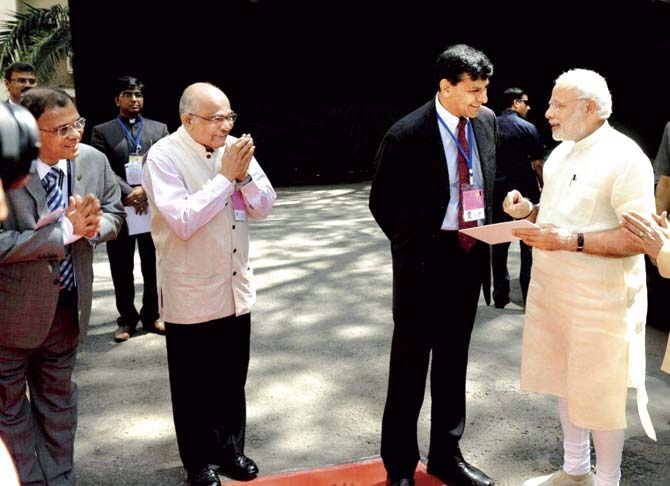

Prime Minister Narendra Modi being received by the Governor of Reserve Bank of India Raghuram Rajan for the financial inclusion conference to mark the 80th anniversary of RBI in Mumbai, last Thursday. Pic/PTI

The broader indices saw the BSE100, BSE200 and BSE500 gain 2.93 per cent, 2.96 per cent and 3.14 per cent respectively. The BSEMIDCAP gained 3.77 per cent while the BSESMALLCAP gained a massive 6.76 per cent. In sectoral gainers, the winners were led by BSEHEALTHCARE up 4.32 per cent followed by BSEREALTY 3.74 per cent and BSEBANKEX 3.37 per cent. There was just one loser in BSEIT down 0.32 per cent.

Oil prices

The initial deal done in Iran with regards to its nuclear installations could see oil prices soften as further oil supplies hit the global scene. Softening oil prices would be a big relief for India and inflation. Incidentally, petrol and diesel prices were cut on April 1. Dow Jones closed at 17,763.24 points a marginal gain of 50.58 points or 0.28 per cent.

The week beginning April 6 will see RBI meet for its monetary policy review on Tuesday, April 7. It is widely believed that there would be no change in rates as there was a surprise cut in March post the Budget. The important thing however could be the tone of RBI governor and what parameters he sets out for inflation going forward.

Sensex lost 2,776 points from its March 3 high of 30,024.74 points in 17 trading days. The rate of fall was an average 163 points per day. The three day rise from close of March 27 to April 1 was 801 points or 267 points per day and we all know that markets fall faster than they rise. This clearly establishes that this rise is certainly unsustainable going forward. This rally was too good and too fast and hoping that the same sustains could be asking for too much.

Results season for the quarter and year ending March 2015 would kick in about a fortnight from now and that would be a big driver for the markets. The fact that there is a general feeling that results may be just a tad below expectation saw prices coming off in March, but with rally they are again expensive. Neither here nor there is how markets would behave in this week.

Market insurance

The year gone by 2014-15 saw a sharp reduction in primary market insurances. Two reasons for the same were that there was a feeling that promoters were expecting much higher valuations than what the market was willing and secondly the government divested its shares through the OFS (Offer For Sale) route compared to the earlier used FPO (follow on offer).

This benefited the government in faster timelines as the issue proceeds, allotment and listing were all over in roughly 48 hours against the earlier almost 15 days including the issue period. Continuing with the primary market shares of Adlabs Entertainment would list on Monday April 6.

Separated by RBI policy shares of Inox Wind Energy are expected to list on Wednesday and the success or failure would determine the mood of a spate of issues expected to open during April. One must remember that the primary market revival is important for the markets and fund raising but valuations have been a key concern.

It is imperative that there is a risk reward ratio in favour of the would be shareholder for buoyancy of primary markets. Greed factor of the promoter merchant banker needs to be curtailed at least at the beginning of the primary market cycle.

The mega merger of pharma major Ranbaxy with Sun Pharma has been cleared and next week is the record date for such entitlement and trading in shares of Ranbaxy would be suspended from Wednesday. RBI has cleared the merger of ING Vysya Bank with Kotak Mahindra.

SEBI dictates

Capital market regulator SEBI has done a great job on providing legislation but the same cannot be said when it comes to implementation and conviction. Take the recent case of Cooper tire and Apollo, the deal began in April 2013 and it was all over post the failed deal and subsequent court case by December 2014.

The SEC has found insider trading and is proceeding with the case. In India we have so many high profile cases which are remaining pending for so many years and there seems to be no timeline to settle. In capital markets, where time is money, justice delayed is justice denied and to be called a real global class regulator, conviction has to become time bound.

It’s just not enough to say that we have the best regulation. The regulation must get results as well. Readers would recall that diversified groups and conglomerates were the flavour of the day and many of them tapped the markets. They came and went and had their day. There is a right offer form GMR Infra currently on and closes on Wednesday. The offer price is at R 15 while the market price is around Rs 16.70.

This company owns the Delhi Airport franchise and recently tapped the international; markets with its bond issue which was very well received, oversubscribed and priced at a reasonable coupon rate. Speaking at a CII event on Capital markets the CFO of the company explained how there is appetite for such paper and the prospects of the group. It looks like an interesting company and may be bought for investment.

The week ahead will be volatile and take direction from what RBI does or says. Nothing is expected and there are no expectations but markets have a mind of their own. Trade with the flow but be prepared for some corrections after a sharp and sweet rally of last week.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd. Readers are invited to read more about these and other issues on his website https://ak57.in

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only and under no circumstances should be used for actual trading or making investment decisions.

Readers must consult a qualified financial advisor prior to making any actual investment or trading decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at his or her risk.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!