State-owned oil firms, which have been since June last year revising auto fuel prices daily, today raised petrol and diesel rates by 18 paise per litre each in Delhi, according to a price notification

Representational Picture

ADVERTISEMENT

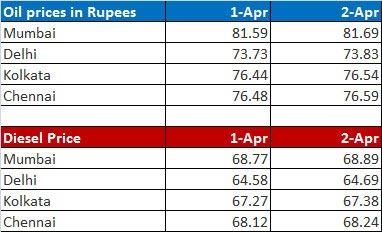

Petrol price today hit a four-year high of Rs 73.73 a litre while diesel rates touched an all-time high of Rs 64.58 in the national capital, renewing calls for the government to cut excise tax rates. State-owned oil firms, which have been since June last year revising auto fuel prices daily, today raised petrol and diesel rates by 18 paise per litre each in Delhi, according to a price notification. Petrol in the national capital now costs Rs 73.73 a litre, the highest since September 14, 2014 when rates had hit Rs 76.06. Diesel price at Rs 64.58 is the highest ever, with previous high of Rs 64.22 being on February 7, 2018.

The Oil Ministry had earlier this year sought a reduction in excise duty on petrol an diesel to cushion the impact rising international oil rates but Finance Minister Arun Jaitley in his Budget presented on February 1 ignored those calls. India has the highest retail prices of petrol and diesel among South Asian nations as taxes account for half of the pump rates.

Jaitley had raised excise duty nine times between November 2014 and January 2016 to shore up finances as global oil prices fell, but then cut the tax just once in October last year by Rs 2 a litre. Subsequent to that excise duty reduction, the Centre had asked states to also lower VAT but just four of them -- Maharashtra, Gujarat, Madhya Pradesh and Himachal Pradesh -- reduced rates while others including BJP-ruled ones ignored the call.

The central government had cut excise duty by Rs 2 per litre in October 2017, when petrol price reached Rs 70.88 per litre in Delhi and diesel Rs. 59.14. Because of the reduction in excise duty, diesel prices had on October 4, 2017 come down to Rs 56.89 per litre and petrol to Rs 68.38 per litre. However, a global rally in crude prices pushed domestic fuel prices far higher than those levels. The October 2017 excise duty cut cost the government Rs 26,000 crore in annual revenue and about Rs 13,000 crore during the remaining part of the current fiscal year.

The government had between November 2014 and January 2016 raised excise duty on petrol and diesel on nine occasions to take away gains arising from plummeting global oil prices. In all, duty on petrol rate was hiked by Rs 11.77 per litre and that on diesel by 13.47 a litre in those 15 months that helped government's excise mop up more than double to Rs 242,000 crore in 2016-17 from Rs 99,000 crore in 2014-15. State-owned oil companies -- Indian Oil Corporation, Bharat Petroleum Corporation and Hindustan Petroleum Corporation -- in June last year dumped the 15-year old practice of revising rates on the 1st and 16th of every month . Instead, they adopted a daily price revision system to instantly reflect changes in cost. Since then, prices are revised on a daily basis.

Catch up on all the latest Crime, National, International and Hatke news here. Also download the new mid-day Android and iOS apps to get latest updates

This story has been sourced from a third party syndicated feed, agencies. Mid-day accepts no responsibility or liability for its dependability, trustworthiness, reliability and data of the text. Mid-day management/mid-day.com reserves the sole right to alter, delete or remove (without notice) the content in its absolute discretion for any reason whatsoever

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!