Proposing to hike the tax exemption limit by Rs.50,000 for all individuals, Finance Minister Arun Jaitley today presented the national budget for this fiscal, promising bold corrective measures to revive the economy

New Delhi: Proposing to hike the tax exemption limit by Rs.50,000 for all individuals, Finance Minister Arun Jaitley Thursday presented the national budget for this fiscal with concerns over economic slowdown while promising bold corrective measures to unburden the poor from rising prices, revive investor confidence and cut excessive expenditure.

ADVERTISEMENT

"People of India have voted decisively for change," Jaitley said in what was the maiden budget for himself and Prime Minister Narendra Modi's government. "Steps I unveil in the budget aim at 7-8 percent growth over the next three-four years, lower inflation, less fiscal deficit and a manageable current account deficit."

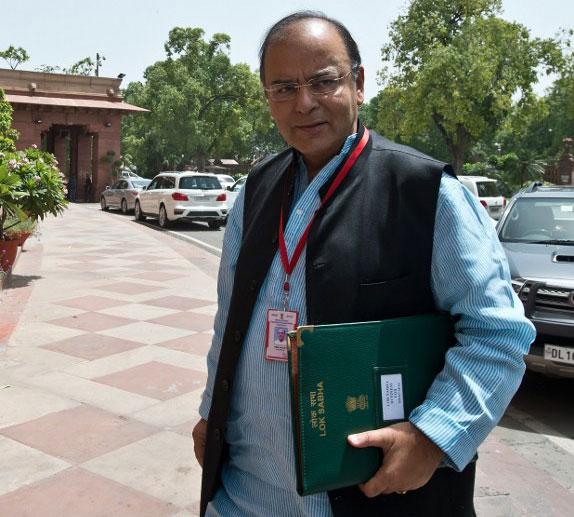

Arun Jaitley. Pic/AFP

The finance minister said he proposed the tax exemption limit for individuals below 60 years at Rs.250,000, subject to parliament's approval, and Rs.300,000 for senior citizens. Deductions allowed under various heads such as investments in insurance, pension and house rent are also proposed to be raised by Rs.50,000 to Rs.150,000.

The minister said given the state of the economy today, high inflation, low growth and moderate rise in tax collections, the fiscal deficit target of 4.1 percent of India's gross domestic product set by his predecessor P. Chidambaram was a "daunting" task.

"But I have decided to accept this target as a challenge," he said, adding he will seek to further bring down the fiscal deficit to 3.6 percent for the next fiscal and to 3 percent in the year after.

He said the country cannot be made to suffer due to indecisiveness and populism and there was an urgent need to revive growth in manufacturing and infrastructure. "We will also examine proposals for more autonomy to banks."

The finance minister said the possibility of a poor monsoon and the Iraq crisis were key challenges with a bearing on both government finances and inflation. But he said the situation will be monitored closely to initiate immediate corrective steps.

"Financial stability is the foundation of our recovery."

Jaitley also promised early introduction of the pan-India goods and services tax, while assuring the domestic and global investment community of predictability in the tax regime to restore confidence about the country's prospects.

The budget for current fiscal comes against the backdrop of the Economic Survey 2013-14, the annual report card on the state of the nation, which has termed inflation-control, job creation and pushing growth as the three main challenges, while calling for a fresh dose of reforms.

Expectations have been high from the budget after Modi came to power with a landslide victory in the general elections, mainly on the promise of ushering in happy days for India's 1.2 billion people by creating more jobs, providing relief from price rise and reviving growth.

Among the various measures, Jaitley announced a national multi-scale programme called Skill India for providing training to youth and their employment, a national irrigation scheme and a smart city with an investment of over $1 billion as part of the larger plan for 100 such projects.

He also announced many other schemes, such as one to help farmers realise right prices for their produce, at least four more institutions modelled on the All India Institute of Medical Sciences (AIIMS), more money for people's welfare, many new airports on public-private partnership mode, a target of total sanitation in five years, greater autonomy for banks and higher investments by state-run enterprises.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!