Home / News / India News / Article /

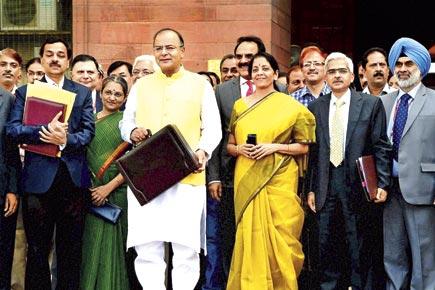

Wanted - a budget full of sweet accidents

Updated On: 11 July, 2014 06:48 AM IST | | Vanita Kohli-Khandekar

<p>It doesn’t take much to kick-start an entire industry. More than a dozen years ago, the Indian film industry was a basket case</p>

Listen to this article :

It doesn’t take much to kick-start an entire industry. More than a dozen years ago, the Indian film industry was a basket case.

It doesn’t take much to kick-start an entire industry. More than a dozen years ago, the Indian film industry was a basket case.

Then, the Maharashtra state government gave the making of multiplexes a 10- year tax holiday. Their success created a trend of sorts and multiplexes sprung up even in states that did not have tax holidays.

Read Next Story