Finance

In a major escalation of Mexico’s security offensive, elite Mexican military and federal forces have successfully neutralized Hugo Cesar Macias Urena, the key cartel lieutenant who assumed operational command of the Jalisco New Generation Cartel (CJNG) after the death of its leader, Nemesio “El Mencho” Oseguera. This targeted operation struck at the heart of the cartel’s command structure, removing its trusted right‑hand strategist and financial logistics chief. WATCH

Updated 2 days ago

The European Union is facing one of its most consequential decisions of the Ukraine war: whether to use frozen Russian central bank assets to help finance Ukraine’s future. Around 210 billion euros in Russian assets, frozen after Moscow’s full-scale invasion in 2022, are now at the center of a fierce debate inside Europe.

Updated 2 months ago

Adani Ports raises Rs 5,000 crore via 15-Year Non-Convertible Debenture (NCD)

Updated 9 months ago

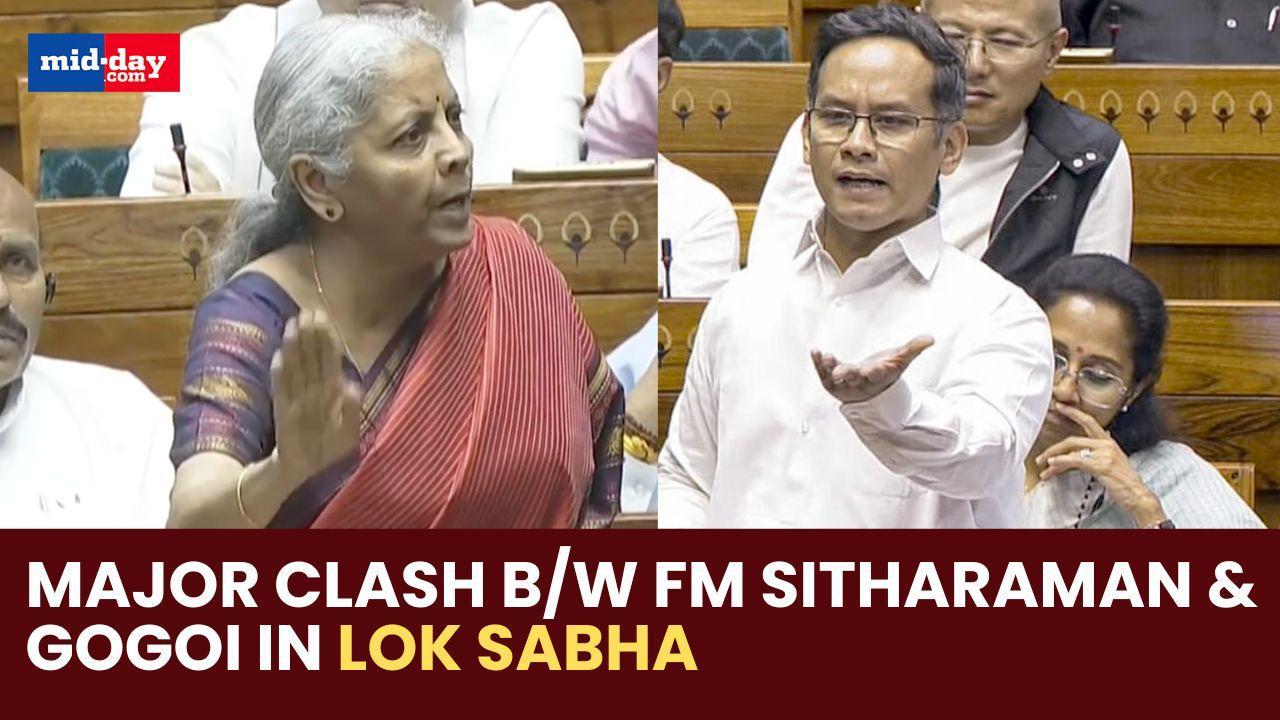

FM Sitharaman and Congress MP Gogoi's face off triggers major disruption in LS

Updated 11 months ago

ADVERTISEMENT

New India Co-operative Bank Scam: Finance Experts dissect the fraud

Updated 1 year ago