It is looking good for now, though caution is advised as volatility is around the corner

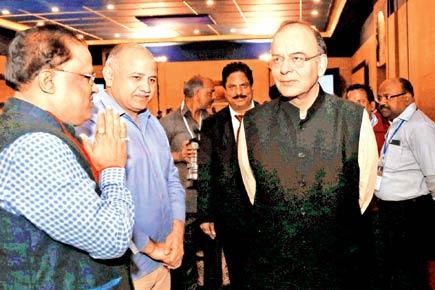

Union Finance Minister Arun Jaitely (r) with Delhi Deputy Chief Minister Manish Sisodia during the 10th meeting of the GST Council at Udaipur. Pic/PTI

Markets managed gains for the week on the back of strong gains registered by HDFC Bank on Friday. Till Thursday, markets were negative on a weekly basis and only because fresh buying was permitted by the Reserve Bank of India (RBI) in shares of HDFC Bank for FIIs, did markets rally. HDFC Bank closed with strong gains on Friday, which helped markets close in positive territory.

ADVERTISEMENT

The BSESENSEX gained 134.50 points or 0.47 per cent to close at 28,468.75 points while NIFTY gained 28.15 points or 0.32 per cent to close at 8,821.70 points. The broader indices saw BSE100, BSE200 and BSE500 gain 0.33 per cent , 0.24 per cent and 0.12 per cent respectively. BSEMIDCAP and BSESMALLCAP both registered losses of 0.34 per cent and 0.98 per cent respectively.

Gainers and losers

In sectoral gainers, the top performer was BSEIT up 1.60 per cent followed by BSETECK 1.37 per cent and BSEHEACARE 1.25 per cent . The losers were led by BSEREALTY down 3.08 per cent followed by BSEAUTO 2.76 per cent and BSEPSU 2.02 per cent . In individual stocks, the top gainer was Vedanta up 6.25 per cent followed by HDFC Bank 5.57 per cent , Gail 5.55 per cent and Reliance 4.37 per cent . The top loser was Tata Motors down 11.13 per cent followed by Bank of Baroda 11.73 per cent, NMDC 6.55 per cent and Hero Motocorp 5.54 per cent . The Indian Rupee lost 13 paisa or 0.195 to close at Rs 67.01. Dow Jones gained 354.68 points or 1.75 per cent to close at 20,624.05 points.

Shiv Sena supporters out in full strength in Kalina, Santacruz. Pic/Datta Kumbhar

Highs and lows

The week ahead has two trading holidays on Tuesday, for civic elections in Mumbai and on Friday for Maha Shivratri. February futures will expire on Thursday, February 23. The current value of NIFTY of 8,821.70 points is higher by 218.95 points or 2.55 per cent compared to the previous expiry of 8,602.75 points. The gains are not substantial, but good enough for bulls to hold on. With a holiday in between, the series could go either way.

The result season for the quarter October to December 2016 is over. The last major result to be declared was from Tata Motors, which was a disaster. Tata Motors share prices fell sharply post results. They lost over 11 per cent for the week. Results were better than expected considering that demonetisation was expected to take a toll on the results.

The tax turn

Kraft-Heinz made a bid to acquire Unilever for 143 billion dollars, which has been rejected by Unilever board. However the market cap of Unilever gained about 60 per cent in a single day after the bid was made and rejected. It will be interesting to see how developments pan out going forward and the reaction to Hind Unilever shares this week. Also, the other entity controlled by Kraft in India is the now delisted Cadbury India.

With various milestones on GST being cleared it appears to be on track for a July 2017 launch. This is a real mega reform for India with just this measure adding about 1-1.5 per cent to India’s GDP. Secondly, this would be a big boost for the organised players in almost all sectors and deal a body blow to the unorganised sector, which has to turn compliant to survive. In such a scenario, market share of organised players would increase and also tax collections of the states and centre.

A defining moment

In what could be described as a defining moment for India and all Indians, the Indian Space Research Organization (ISRO) launched PSLV with a world record 104 satellites. This week not only has two holidays, but it also has an expiry. Historically, it has been seen that a midweek holiday causes a loss in momentum. With expiry also slated, markets are likely to turn volatile. Trade cautiously.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd.

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!