Investors need to look out for key events scheduled this week, instead of taking hasty decisions

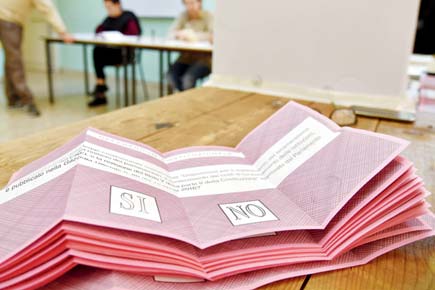

A picture shows ballots in a polling station during a referendum on constitutional reforms, yesterday in Rome. Italians began voting in a constitutional referendum on which reformist Prime Minister Matteo Renzi has staked his future. Italy has had 60 different governments since the constitution was approved in 1948. Pic/AFP

ADVERTISEMENT

On Friday, Nifty closed below the psychological support level at 8086. It looks moderately weak. Continuous FII selling and shaky global market cues are key reasons for weakness. Global investors are staying on the sidelines, ahead of the Italy’s referendum which will be known by the time you read this report. Investors are also keenly watching Federal Reserve’s policy meet, slated for December 14. If FED increases interest rates, we can expect further pull out from global equity markets by investors.

Phase it out

Nifty has immediate resistance at 8193 and 8246; if Nifty manages to move above these two levels, thoughone has to admit that chances of that happening are remote, then one can expect further uptrend. Nifty has support at 7965 and 7916. If these two levels have been taken off then it could test the panic bottom at 7820. It is prudent to reduce all speculative positions, but one can buy stocks for a medium to long term perspective at every decline, in a phased manner. The long term charts are still looking bullish so Nifty can scale back its previous highs without much time delay. The weekly charts of the Nifty also indicates an oversold situation, but it has not given a buy signal.

A great deal of important macro data is expected to be out this week, like US Balance of Trade, Continuing Jobless claims and Initial jobless claims, GDP Growth rate, Industrial production, Balance of Trade and Nonfarm payroll from EURO zone and Nikkei Service PMI from India are among them.Corporate earning of Ballarpur, DCW, Surya Roshni, Venkey’s, Kerbs Bio, Prestige, SAIL, MMTC and ROLTA will also is out.

Expectation from meet

Banking Nifty is weak but can move up ahead of December 7, ahead of the RBI policy meet. If RBI reduces interest rates more than the 25 basis points, then one can expect a sharp uptrend in the backing counters including in the private and public sector. Banking Nifty has support at 18124 and 17797. It has resistances at 18703 and 18955.

Price declines can be utilised to buy front line banking stocks for a medium term perspective. We saw mild recovery on the IT index, but upside is capped, and it could move up further after a minor correction. IT index has support at 9777 and 9489. It has resistance at 10174 and 10254. Like banking stocks, IT front line stocks can be bought in small quantities, as they have entered in the oversold region.

Look at Dow

The Dow Jones looks very strong, but it is slightly overbought, so one can expect profit booking from higher levels. It has resistance

at 19263 in the short term.Caution should be taken from higher levels; the good news for Dow is that the S&P VIX is on decline mode. Whereas India VIX remains very strong and it closed at 17.93, which indicates uncertain market conditions with higher volatility.

Crude is looking strong after the OPEC decision to cut oil production to keep prices firm. Crude has support at $49.86 and resistance at $ 52.63 and $55 in the medium term, if the current scenario continues.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!