Victims of QNet scam stuck in vicious cycle of being baited with sham products, broken relations and shattered dreams

ADVERTISEMENT

A glass ‘bio disk’ fashioned in the shape of an orb was Gurupreet Singh Anand’s last straw. The Andheri resident blew the whistle on the multi-crore QNet scam in 2013 when he found that his wife was being persuaded by the pyramid scheme’s representatives to shell out R31,500 for the disk that was said to diffuse healing properties. Anand stopped that cheque from going through, and finally -- after repeatedly failing to get promised returns -- filed a police complaint. The behemoth scam -- it had nearly 90,000 members across the country at the time -- began to crumble, but its victims are still trying to piece their lives back together.

Air purifier for Rs 40,000

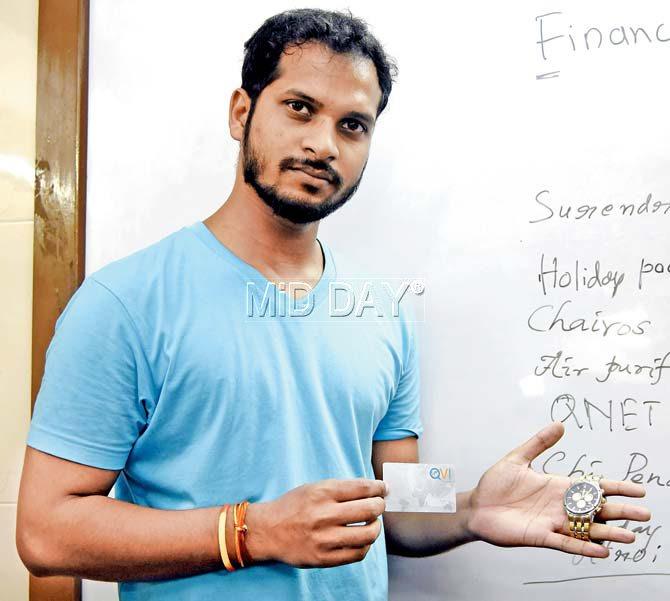

Vinay Kalasapur was also persuaded to buy a chi pendant for Rs 54,000

Vinay Kalasapur was also persuaded to buy a chi pendant for Rs 54,000

The sham bio disk wasn’t the only bait in QNet’s oeuvre. There were holiday packages, ‘limited edition Swiss’ watches, a mini-MBA programme, calcium tablets and imitation jewellery -- all given to new members under the complimentary umbrella.

Vinay Kalasapur (32), who took a bank loan of R9 lakh to join the scheme last year, got a vacation package, with choices of resorts in India and abroad. “I never went on a vacation, though. I was too busy working and then following up with QNet sessions in the evenings,” says the Turbhe-based research scientist who was swayed by promises of good returns. “QNet trainers kept saying we had to work hard to be able to enjoy the fruits of our labour in five years.”

The trainers’ pitch plunged him deeper into the scam’s abyss. He was coaxed into buying an air purifier, that costs R16,000, for R40,000, and wore a chi pendant worth R54,000. “I didn’t feel energised even for a minute like the company had claimed,” he rues. He got a few friends to join as well. “I felt very guilty once I realised this was a scam. I wanted them to get their money back. I had taken a loan to join QNet and am now repaying it in instalments,” says Kalasapur, adding that the QNet experience was ‘the darkest period’ of his life.

Holiday package

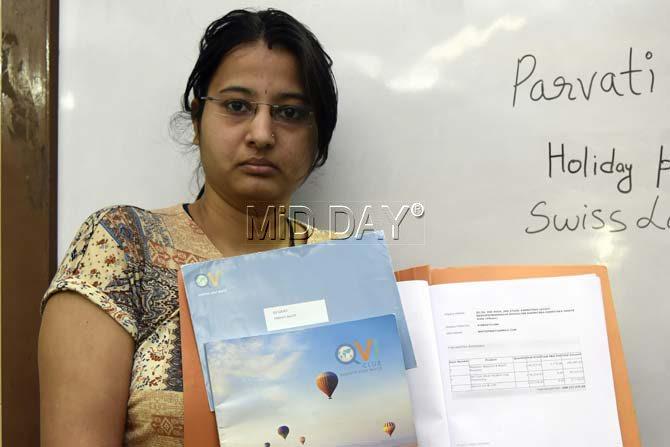

Parvati Kankrej with her holiday package

Parvati Kankrej with her holiday package

Parvati Kankrej (27), a software professional from Thane, was lured into joining QNet in July last year by her brother-in-law. She took a bank loan of R6 lakh to sign up for it. “I got a holiday package with resorts in Thailand and Sri Lanka. But when I called the resorts, some of them said I had to pay $500 more to actually book a room. I also had to pay R25,000 annually to keep the package active,” she says.

Revealing the scammers’ modus operandi, Kankrej says an ‘independent representative’ swiped his card for a large sum if a person did not have sufficient money to sign up on the spot, as was the case with her. “Then began the phone calls to pay back that amount to him,” she says.

Kankrej says the scam has taken a toll on her family life.

Refund? Fat chance!

Amish Vyas thought QNet was an e-commerce platform when he signed up

Amish Vyas thought QNet was an e-commerce platform when he signed up

Amish Vyas (33) was led to believe that QNet was an e-commerce platform when he rustled up R12.90 lakh from his personal account as well as those of his wife and father-in-law.

“I attended my first QNet session at a Thane hotel. The police raided the session and took away QNet representatives. I was shocked. I asked for a refund, but the representatives laughed and said there was no chance of getting one,” says the ITISâÂÂu00c2u0080ÂÂu00c2u0088professional from Bhayander.

Vyas says his loan burden is triggering “bouts of depression. I have to repay my father-in-law. I already have a home loan. A relative brought me into this scheme, but I don’t blame him. He lost R30 lakh, thinking it was genuine. He is actually finding it difficult to even survive.”

Blind trust

Surendra Kushwah with the ‘limited edition Swiss watch’ that he was given

Surendra Kushwah (30), IT professional residing in Thane, too, thought he was investing in an e-commerce platform when he signed up mid-2015, even though he wasn’t shown a business plan. “A very trusted friend told me to invest in this business opportunity,” he recalls.

He was conned into parting with R3.5 lakh in total, after a token amount of R10,000, with the pitch: “You need lakhs, not thousands, to realise your dreams.”

Kushwah was led to believe that he would be rubbing shoulders with senior officials. He met representatives at a fast food chain at a Bhandup mall, “where an atmosphere was created to show that I was being offered a top business position and was going to be meeting seniors. I was told I couldn’t afford to be rejected.”

Kushwah claims that he took a bank loan at a 14 per cent interest for the scheme. “I went to the first meeting, where I learnt about the scheme from three representatives. That’s when I realised that this was not what I had thought it to be. I was constantly reassured and my friend kept asking me: ‘Don’t you trust me?’ when I questioned him.”

The one-month refund policy had already lapsed by then.

Kushwah was also goaded into getting two friends to join. “I felt guilty that I was fooling people,” he says. In his complimentary welcome package, he got a ‘limited edition Swiss watch’, “which looks nothing like any designer watch”. “I got a holiday package of R2.15 lakh, too.”

Kushwah says he was pressured into roping more members, and focusing on QNet hit his work. “My boss reprimanded me frequently since I could not concentrate on my work. I had just got engaged then (he’s married now). I stopped being part of QNet in two to three months.”

He’s still repaying his loan, and has lost friends owing to the scam.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!